Figure 1: Investing in fine spirits means setting your capital growth goals on foundations as solid as the centuries-old legacy of some of the world’s most celebrated distilleries. Pictured: a glimpse of our visit to the Rosebank distillery, founded in 1840.

In recent years, the world of investing has seen growing interest in alternative and unconventional assets. While attention was once focused almost exclusively on financial instruments and real estate, today many investors are also turning to tangible and rare goods that combine economic value with collectible appeal. Among these, fine spirits such as whisky, rum, cognac, and bourbon have carved out a significant niche as diversification opportunities. But who is this type of investment really suitable for?

Investment in Traditional Assets

When it comes to investing, most people immediately think of traditional instruments such as stocks, bonds, mutual funds, or real estate. These assets offer solutions tailored to different risk profiles: from government bonds—considered safe but with low returns—to emerging market equities, which are more volatile but “potentially” more profitable.

However, in recent years, investors have had to contend with low interest rates, rising inflation, and unstable stock markets. In this context, there has been an increasing search for diversification and safe-haven assets capable of protecting capital and generating solid capital gains. This is where alternative assets, including fine spirits, come into play. Investing in rare whisky and collectible rum has become more than just an alternative asset class—many large investment funds and banks now have departments dedicated exclusively to these goods, offering them as an important component of their clients’ portfolios.

This trend reflects the growing demand from both institutional and private investors for assets that are uncorrelated with traditional markets, capable of providing stability and profitable returns even during times of high financial volatility. Furthermore, the global market for rare spirits is backed by increasingly robust data: dedicated indices track the performance of prices and auctions, confirming returns that often surpass those of other safe-haven assets such as gold or art. Added to this is the growing interest of new generations of investors, who are attracted not only by the economic potential but also by the emotional and cultural aspects that such collectible goods can offer.

Figure 2: Investing in indices or equities carries a high risk of volatility, combined with the inherent risks of assets not backed by tangible goods. Note the mandatory financial markets disclaimer: “losses may exceed invested capital.”

Investing in Fine Whisky and Rum Bottles

Fine whisky and rum are not merely products to be enjoyed—they have become genuine collectibles over the past few decades. Some limited editions, bottled in extremely small quantities, have seen their market value rise significantly on the secondary market, with auctions reaching six-figure sums.

The appeal of these spirits lies in their rarity, quality, and the stories they carry. A distillery that has long been closed, a bottle produced in only a few hundred units, or a label particularly prized by connoisseurs can become highly sought-after assets among collectors and investors worldwide.

Compared to other types of alcoholic beverages such as wine, which can deteriorate over time, spirits have a distinct advantage: once bottled, they not only cease to evolve but also retain their characteristics indefinitely. Thanks to their high alcohol content, which prevents spoilage, they can remain perfectly preserved for decades or even centuries. This makes the investment more predictable and secure in terms of preservation.

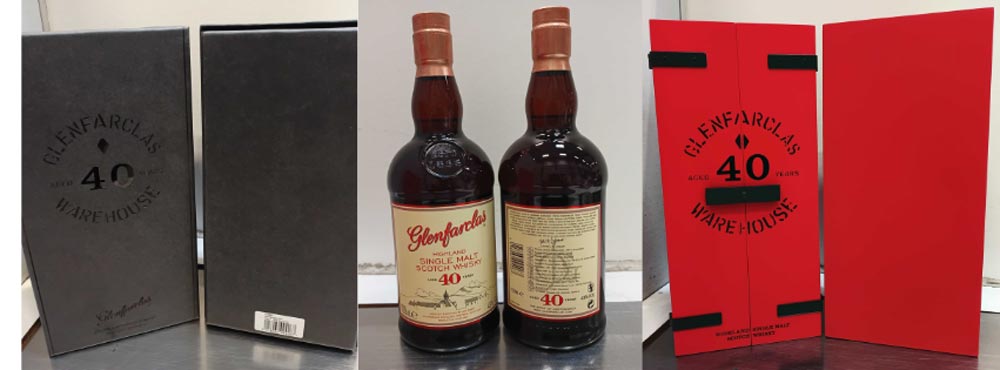

Figure 3: Glenfarclas 40 Warehouse Bottling—an example of a tangible asset embodying rarity, durability, and liquidity.

A frequently overlooked aspect of investing in fine spirits concerns taxation. In several European countries, including Italy and the United Kingdom, rare spirits are classified as consumer goods. This means that buying and selling collectible bottles is not subject to capital gains tax, unlike stocks, bonds, or real estate.

In practice, if an investor purchases a rare whisky bottle and sells it years later at a higher price, the profit can be pocketed entirely tax-free. This is a significant advantage, especially in markets where the tax burden on traditional investments can exceed 20–26% of profits.

This feature makes rare whiskies particularly attractive for those seeking diversification that not only protects against inflation but also optimizes the tax efficiency of their portfolios. Naturally, tax regulations vary from country to country, and it is always advisable to consult a specialist before making substantial transactions. Nonetheless, the “collectible” and tangible nature of these assets often makes them more tax-efficient than many other forms of investment.

Figure 4: Rare whisky investing combines profitability with passion and exclusivity—owning one of these bottles can become a fortune after years of careful stewardship.

Why a Tangible Asset?

The main difference compared to traditional financial instruments is that a bottle of fine spirit is a physical, tangible asset. This brings several advantages:

- Inflation protection: as a real and limited good, it tends to maintain or increase its value over time.

- Rarity and uniqueness: supply is by definition limited; once a bottle is consumed or broken, global availability decreases, increasing the value of the remaining ones.

- Global market: demand for fine spirits is international, involving collectors from Europe to Asia, making the asset more liquid than one might think.

- Portfolio diversification: including a non-correlated asset alongside equities or bonds can significantly reduce an investor’s overall risk.

However, given the specific characteristics these collections must possess, this is not a simple investment. It is essential to know the reference market very well and to rely on competent experts who can verify the authenticity, condition, and provenance of the bottles.

Conclusions

Ultimately, fine spirits represent an exclusive and potentially lucrative addition to a well-diversified portfolio. For those who enjoy combining investment with passion, they can prove to be not only profitable but also deeply fascinating assets.

In this context, specialized firms such as The Spirits Club have emerged—companies dedicated exclusively to investing in fine spirits, serving an international clientele and providing support both to beginners and experienced investors seeking carefully selected opportunities in a complex, growing, and ever-expanding market.

Why invest with The Spirits Club?

Our expertise is to identify the labels suitable for investment purposes and capable of generating profits above the market average.

- Investment in rare and prestigious bottles worldwide

- High experience in the search and availability of bottles

- Product and management transparency

- Exclusive ownership of the investor

- Pool of experts at the top of world collecting in spirits

- Portfolio managers experienced in the management of luxury assets

- Ongoing advisory approach to investors

- Indication of the best moment of liquidation of the product

- Possibility to liquidate at any time in case of need.